Does My House Owners Insurance Cover Flood Damages? Comprehending Your Plan Restrictions Home owners insurance coverage covers damages to your home and personal effects from the weight of rainfall, snow, and ice. If an ice dam kinds on your roofing system and creates it to collapse suddenly, bring about rain and ice entering your home, you would certainly be covered for both the damages to your roofing and for the damages from the rainfall. The same chooses your home, items, and various other covered frameworks on your home if they're harmed by the weight of rainfall, snow, or ice. When you submit a home insurance case, your insurance policy carrier will examine the damage and see to it the damage is covered. under your particular plan. If it is, they'll usually provide you a negotiation deal that you're cost-free to approve or object to if you believe it's too reduced. Groundwater is normally happening water underground whose degrees may boost after hefty rainfalls or snow melts, which can be damaging to basements. Nevertheless, your house owners insurance coverage commonly will not cover damages from groundwater. Standard house owners, tenants, and apartment plans do not cover water damage as a result of the failure of a sump pump. Some of these endorsements still omit coverage if failing is due to a flooding. You might purchase flood insurance coverage covering up to $250,000 of flood damage to your home. Requirement home owners, renters, and condominium policies just offer loss of use and additional living expenses for any covered peril. A flooding insurance policy normally will not enter into impact up until one month after you purchase the plan. Water damages can create severe damage to your home, swiftly completing hundreds of bucks in damages and requiring months of restoration. You might believe it won't take place to you, yet regardless of where your home is located or just how recently it was built, water damage is a very genuine possibility. The offender can range from a blocked drainpipe to a ruptured pipe, damaged dishwashing machine, roofing system leakage or something else. If you're uncertain whether you have mold and mildew coverage or the quantity of coverage you have, call your insurance policy agent or company for further descriptions. Requirement Homeowners policies just cover particles removal if a protected danger causes the loss. Some comprehensive plans, nonetheless, have actually included a minimal amount of protection, i.e., $500, while various other companies will give a recommendation to cover food spoilage. Criterion house owners, occupants and condo policies do not cover food putridity as an outcome of power failing when the root cause of the failing is off premises. Additionally, adjustments in weather patterns, infrastructure growth, or drain systems can increase flood dangers in locations that formerly had little to no flooding activity. For instance, a brand-new construction job in your neighborhood can change water circulation, enhancing the probability of flooding near your home.

What Sorts Of Rain Damage Are Not Covered?

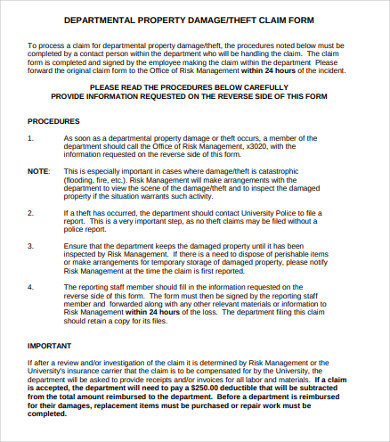

If your homeowners' insurance policy claim has been refuted, you can appeal the decision. Let a skilled Michigan building insurance coverage claims lawyer assistance. At Fabian, Sklar, King & Liss, our group understands the irritation that denied cases can bring. We'll assist you oppose the choice and will represent your interests with your insurance supplier to aid https://kylerwqzm072.yousher.com/when-should-i-get-a-legal-representative-while-applying-for-ssdi you get the money you require for repair work. If you live in a flood plain, near a river or if you live near the shore, you ought to think about acquiring flooding insurance for your home.- This implies the policy will certainly cover the quantity needed to restore your home as it was prior to the damage.Standard property owners, occupants and condo policies do not cover food perishing as a result of power failure when the root cause of the failing is off properties.For example, if slow-leaking pipelines trigger damages because of inappropriate maintenance, the insurance company will likely refute the claim.

What Kind Of Water And Mold Damages Isn't Covered?

What kind of water damage is not covered by property owners insurance?

Flooding is the No. 1 natural catastrophe website in the USA, yet home owners insurance doesn't cover this risk. Essentially, any type of water that flows right into your home from the ground isn't covered. So rain, a rising river and saturated ground aren't covered.

Does Homeowners Insurance Coverage Cover Personal Effects?

We generally first consider rains and flooding when we envision water damage. A heavy rainstorm, overwhelmed water drainage system, or other body of water overflow can quickly trigger a flood. Because flooding can occur at any time (and is hard for insurance companies to anticipate) it's not functional to include it in conventional homeowners policies. Water damages brought on by a ruptured pipe will usually be covered by your home owners insurance plan, as long as the discharge was abrupt and accidental. Personal effects protection, however, typically does not reach damages triggered by wild animals. Flooding occurs in moderate- to low-risk areas as well as in high-risk locations. Poor drainage systems, quick accumulation of rainfall, snowmelt and broken water mains can all cause flooding. Feature on a hillside can be damaged by mudflow, a protected peril under the Standard Flood Insurance Coverage. In risky locations, there goes to least a one-in-four possibility of flooding during a 30-year home loan. For these reasons, flooding insurance coverage is called for by regulation for structures in risky flood areas as a condition of getting a home loan from a government managed or insured lender. Flooding can happen in many methods, consisting of hefty rainfall, tornado rises, or overflowing rivers. If floodwaters harm your home, you'll require a different flood insurance policy to cover the repair expenses. Without flood insurance policy, you'll be accountable for paying for the damages expense, which can quickly come to be frustrating. According to the Federal Emergency Monitoring Firm (FEMA), just 1 inch of floodwater in your house can trigger more than $25,000 in damages. While floodings are the most typical natural catastrophe in the United States, insurance policy coverage for losses from floods is not provided in standard home owners or tenants plans. Insurance policy for flood damages is usually offered under a separate plan released with the National Flooding Insurance Coverage Program (NFIP) and offered to house owners, occupants and organizations.